Trends in China’s Bond Market Following the New Securities Law

2020.05.11 XIE, Qing (Natasha)、 Austin Zhang、 Linky GONG、 Qixing Geng、Hao Fang

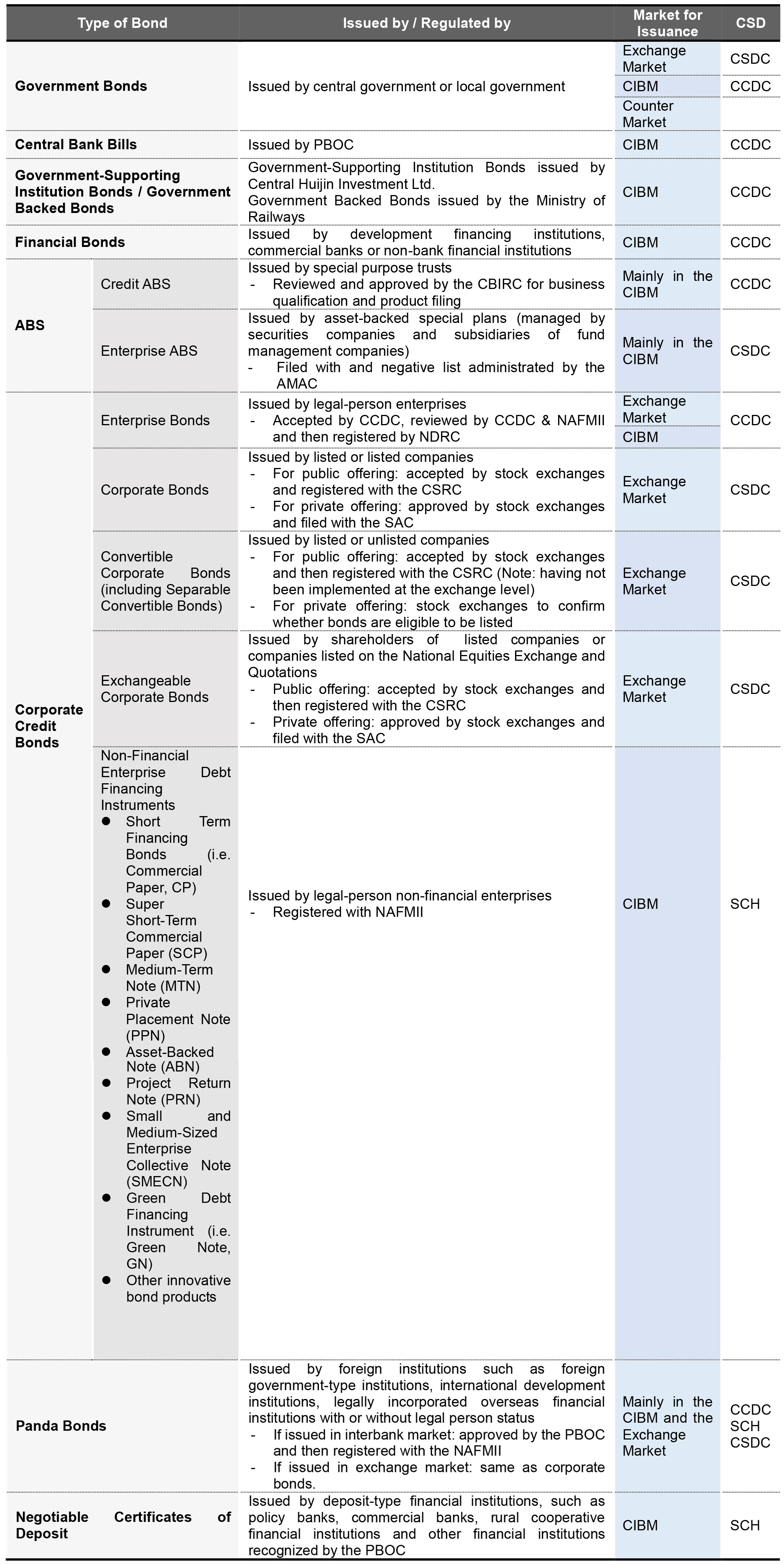

By January 2020, the balance of bonds under custody in the China market had reached a total value of RMB 100.4 trillion, making China’s bond market the second largest in the world in terms of market size. The tradable products include treasury bonds, local government bonds, financial bonds, corporate credit bonds (i.e. corporate bonds, enterprise bonds and non-financial enterprise debt financing instruments), negotiable certificates of deposit and panda bonds (see Appendix I: Major Tradable Products in China’s Bond Market). On March 11, 2020, in the Q&A session jointly held by the People's Bank of China (PBOC) and the China Securities Regulatory Commission (CSRC) with respect to making the bond market serve the real economy ("Q&A"), the regulators provided responses in three key areas related to the China Interbank Bond Market (CIBM): market supervision and regulation, investor protection, and market opening up. This article seeks to briefly update and summarize the observations of the recent trends in legislative and law enforcement development of the bond market following the implementation of the new Securities Law.

I Governing Law

The Q&A clarified the governing law in the interbank bond market following the implementation of the new Securities Law, stating that the issuance, trading, registration, custody, settlement of financial bonds and non-financial enterprise debt financing instruments, both of which are issued and traded in the interbank market, are still governed by the existing regulations and rules formulated by the PBOC and its designated institutions in accordance with the Law of the People's Republic of China on the People's Bank of China. Underwriters (such as commercial banks) and intermediary service providers (such as credit rating agencies) still conduct businesses on the interbank bond market in accordance with existing laws and regulations.

The above statement shows that though in theory, the securities defined in the new Securities Law should include financial bonds and non-financial corporate debt financing instruments issued and traded in the interbank market, therefore the principles and relevant provisions of the new Securities Law should be applicable to the above bonds or debt financing instruments, our observation is that, based on a pragmatic stance, the Chinese government has decided to maintain the current regulatory regime in the interbank bond market in terms of bond issuance, trading, registration, custody and settlement, for a certain period of time. It is clear that the interbank bond market is still regulated according to the existing rules and regulations established before the implementation of the new Securities Law, that is, the new Securities Law does not apply to interbank bond market to the extent governed by the existing rules and regulations.

II Unified Law Enforcement

That fact that the rules and regulations governing bond issuance, trading, registration, custody and settlement in the interbank bond market remain unchanged does not contradict the Chinese government’s pragmatic approach to require the collaboration under a unified coordination mechanism among different regulatory agencies supervising different markets, and further, to require the unification of the law enforcement authorities and activities in both the interbank bond market and the exchange bond market, even though the regulations governing the two markets are separate.

The PBOC, the CSRC and the National Development and Reform Commission (NDRC) jointly issued the Opinions on Further Strengthening the Law Enforcement in the Bond Market (“Opinions on Unified Law Enforcement”) in December 2018, which clarifies that it is the CSRC which should exercise unified law enforcement power over both the interbank bond market and the exchange bond market. Previously, since the National Association of Financial Market Institutional Investors (NAFMII) is just a self-regulatory organization under the PBOC, it can only conduct self-regulatory supervision of the interbank bond market. Compared with administrative penalties imposed by the CSRC in relation to corporate bonds, the supervision and investigation of relevant violations by the NAFMII are relatively weak, which creates a possibility for regulatory arbitrage in both markets. The Opinions on Unified Law Enforcement point out that the CSRC may penalize relevant violations in accordance with the Securities Law. We look forward to more enforcement actions by the CSRC in the future along with the continuous development of law enforcement practices in the bond market.

In addition, pursuant to the Opinions of the CPC Central Committee and the State Council on Building a More Improved System and Mechanism for Market-oriented Allocation of Elements issued on March 30, 2020, the information disclosure standards for corporate credit bonds will be unified, and the unified entry requirements for rating agencies in the bond market will be further improved. Of note, in recent years, the PBOC and the CSRC have been working together to promote the unified regulation of the rating market, including mutual recognition of the qualifications of rating agencies, information sharing on supervision and management of credit rating agencies and industries among regulators, and joint law enforcement actions over and unified penalties on violations.

In terms of dispute resolution, the Meeting Minutes of National Courts’ Trial of Cases Concerning Bond Disputes (Consultation Paper) issued on December 24, 2019 provide that same standards for trial apply to corporate bonds, enterprise bonds and non-financial enterprise debt financing instruments, all of which has a common feature of repayment of principal with interest, so as to ensure that the legal consequences and social impact arising from the trial of relevant cases are consistent. We believe that the application of uniform standards for trial of all types of bonds or debt financing instruments by the courts would help to protect bond investors.

III Protecting Investors and Handling Bond Defaults

Unlike corporate bonds listed in stock exchanges, previously there were no detailed and comprehensive rules or policies with respect to bondholders’ meetings and bond trustee for bonds issued in the interbank bond market. The three basic legal documents issued in December 2019 including the Guidelines on the Handling of Defaults and Risks with Respect to Non-Financial Enterprise Debt Financing Instruments as well as the Procedures for the Public Offering and Registration of Non-Financial Enterprise Debt Financing Instruments (Version 2020) released in April 2020 require to further refine the terms regarding investor protection, bondholders’ meetings and bond trustee in the bond issuance documents, such as incorporating the cross-default clause that is commonly used in overseas bond markets. Upon the occurrence of any bond default, investors can assert their rights in accordance with the procedures and methods stipulated in the aforesaid clauses, thereby improving the efficiency of creditor protections.

The Announcement on Matters Related to the Business of Transferring Default Maturity Bonds issued by the PBOC on December 31, 2019 and the Rules of the National Interbank Funding Center on the Transfer of Default Maturity Bonds in the Interbank Bond Market issued by the China Foreign Exchange Trade System (CFETS, also known as the National Interbank Funding Center, NIFC) in March 2020 provide detailed rules on matters related to the transfer of default maturity bonds in the interbank bond market.

According to the announcement of the CFETS, the first cross-border transfer of matured defaulted bonds in the interbank bond was completed on April 17, 2020. The relevant medium-term note reached maturity in advance as the issuer entered bankruptcy reorganization proceedings and was unable to repay the principal and interest on time, thereby generating default on maturity. The bond holder was a foreign asset management product (AMP) trading in the interbank bond market via the settlement agency. This is the first sale of matured defaulted bonds by a foreign bond holder in the interbank bond market, which conducted its exit via a domestic market making institution and was facilitated by involvement of a variety of institutions, such as specialized asset disposal institutions and investment institutions with high-yield bond investment strategies.

IV Opening Up for Foreign Investors

Since 2019, the PBOC and the CSRC have been optimizing and improving the opening up of the bond market. On July 20, 2019 the Financial Stability and Development Committee of the State Council announced several measures to further open up China’s financial sector, which explicitly allow foreign institutions to carry out bond rating business with respect to all kinds of bonds traded in the interbank bond market and the exchange bond market while conducting credit rating business in China. Foreign institutions are also permitted to obtain the type-A main underwriter license in the interbank bond market. In January 2019, S&P Global Rating (China) Co., Ltd. successfully registered with the NAFMII, marking the official opening up of the domestic credit rating industry for foreign investment. The introduction of foreign-invested rating agencies and underwriters may help foreign investors better understand the disclosure documents required for the bond issuance applications and reduce the related communication costs. Additionally, the PBOC is also committed to further simplifying the entry requirements for foreign institutions and extending the settlement cycle, thereby providing a more convenient environment for foreign investors.

We will continue to monitor the situation and keep our clients apprised of any important developments.

Appendix I:

List of Abbreviations:

ABS: Asset-Backed Securities

AMAC: Asset Management Association of China

CBIRC: China Banking and Insurance Regulatory Commission

CCDC: China Central Depository & Clearing Co., Ltd.

CIBM: China Interbank Bond Market

Counter Market: Counter Market of Commercial Banks

CSD: Centralized Securities Depository

CSDC: China Securities Depository and Clearing Corporation Limited

CSRC: China Securities Regulatory Commission

NAFMII: National Association of Financial Market Institutional Investors

NDRC: National Development and Reform Commission

PBOC: People’s Bank of China

SAC: Securities Association of China

SCH: Shanghai Clearing House