Deconstructing ESG: The Determination of Material Topics

2022.05.22 ZHU, He (George)、NI, Tianling (Carey Nee)、SHI, Di、LIN, Peng

Introduction

Environmental, Social and Governance (“ESG”) is an investment philosophy as well as an evaluation criterion to measure the sustainability of the business operations of enterprises and their impact on society from an environmental, social and governance perspective. In a previous series of articles regarding ESG, we discussed the concept of ESG and the regulation changes of the Science and Technology Innovation Board with respect to ESG information disclosure. This article discusses the ESG material topics, an important starting point for ESG information disclosure, and how the materiality principle could be applied in practice to determine material topics.

I. Why does the determination of material topics matter?

ESG covers a wide range of topics in almost all aspects of corporate operations, from climate change, energy management, waste and pollution prevention from an environmental perspective. It also takes in workforce health and safety, product quality and safety, data security and privacy protection, supply chain management from a social perspective, and shareholding structures, shareholders' interests, board independence and diversity, and enterprise risk control (e.g., anti-corruption and anti-bribery) from a corporate governance perspective.

II. What are the material topics?

Are all ESG topics of equal importance to each enterprise when preparing an ESG report? The answer is no. Although an enterprise may be related to various ESG topics, not all these topics are worthy of being included into the ESG report and only those of sufficient importance constitute “material topics.” Therefore, the identification of material topics is an important starting point for ESG information disclosure, the preparation of ESG reports, and the core of ESG management.. “Materiality principle” is a basic principle to assist enterprises in identifying and analyzing material topics.

III.How to identify material topics

1. Identify material topics in accordance with the materiality principle under the GRI Standards.

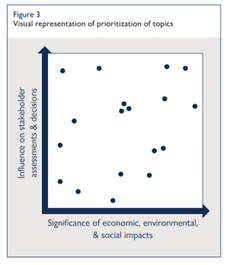

According to the GRI Standards, enterprises may identify material topics based on the materiality principle by assessing the two following dimensions: (1) the significance of the economic, environmental and social impact on the organization and (2) the influence on stakeholder assessments and decision making. The stakeholder refers to the entities or individuals that can reasonably be expected to be significantly affected by the reporting organization’s activities, products and services, included but not limited to employees and other workers, shareholders, customers, suppliers, vulnerable groups, local communities, government authorities, NGOs or other civil society organizations.

The GRI Standards also provide a “material topics matrix” as the methodology and tool for the analysis of material topics (such as the sample matrix below), which presents the two dimensions mentioned above for assessing material topics, and a topic can constitute a material topic based on one of these dimensions. The material topics matrix allows enterprises to determine the relative priority of each topic and ensure that the ESG report focuses on those topics with a relatively high priority.

2. Identify material topics under SASB Standards

In addition to the GRI Standards mentioned above, the Sustainability Accounting Standards Board (“SASB”) has developed industry-specific materiality standards (the “SASB Standards”). Specifically, the SASB has established the Sustainable Industry Classification System (the “SICS”), which covers 11 sectors and is further divided into 77 industries; on this basis a Materiality Map® covering these 77 industries has also been made under SASB Standards. Compared to the material topics matrix proposed by the GRI Standards, considering the idiosyncratic material topics limited to each industry, the material topics tailored by the SASB Standards for each industry provide clear guidance as well as a foundation for enterprises to determine their specific ESG material topics. It also promotes the comparability of ESG information disclosures. Taking the chemical industry as an example, according to the SASB Standards, the material topics in the chemical industry include:

Greenhouse Gas Emission

Energy Management

Air quality

Water Management

Hazardous waste management

Community relations

Workforce health and safety

Product design for use-phase efficiency

Safety & Environmental Stewardship of Chemicals

Operational Safety, Emergency Preparedness & Response

Management of the Legal & Regulatory Environment

3. Material topics with Chinese characteristics

The group standard of the Guidance for Enterprise ESG Disclosure (T/CERDS 2-2022) published by the China Enterprise Reform and Development Society on April 16, 2022, will take effect on 1 June this year. It is the first enterprise ESG disclosure standard in China. Subject to the prevailing Chinese laws, regulations and standards, and combined with China’s actual situations, it provides guidance for Chinese enterprises to carry out ESG disclosure. It includes various ESG topics with Chinese characteristics, such as setting up the “national strategic response” indicator under social factors, including but not limited to an enterprises’ response to rural revitalization, manufacturers of advanced and quality products, high-quality development, invigorating China through technology, education and human resource development, common prosperity and other national strategies.

IV. Our suggestions

When identifying material topics for the purpose of ESG information disclosure, Chinese enterprises should make comprehensive considerations. Besides the international ESG disclosure standards (including but not limited to GRI Standards and SASB Standards, depending on the choice of the enterprise) as applicable references, Chinese enterprises should also comply with the local requirements of information disclosure under the applicable Chinese laws, regulations, applicable standards and other supervision requirements with localized characteristics (such as the ESG topics with Chinese characteristics indicated in the group standard of Guidance for Enterprise ESG Disclosure), combined with the actual needs of business operation and risk control. Stay tuned as JunHe’s ESG team will be interpreting the group standard of Guidance for Enterprise ESG Disclosure in our upcoming research brief.

If you have any questions regarding the voluntary or mandatory ESG disclosure requirements, please contact us via email. Additionally, if you need assistance with the drafting or reviewing of ESG reports, the construction of ESG management systems or strategy enhancement (including drafting or reviewing ESG-related internal rules and regulations), ESG due diligence, the design of a carbon reduction approach and plan, the development of carbon reduction and energy monitoring systems or ESG training, please contact us via email: ecoenvpro@junhe.com.

The JunHe EHS and ESG Team: JunHe, with over 1070 professionals, is one of China’s largest full-service law firms with an international reputation in providing high quality legal services. As one of the pioneers in the practice area of ESG in China and one of the largest teams of environment, health and safety (EHS) lawyers in the country, JunHe provides clients with a full range of EHS and ESG legal services. Our team is sustainability-oriented and provides EHS compliance audit services for enterprises with different industrial backgrounds depending on the specific needs of the clients, either alone or in collaboration with third-party agencies. JunHe relies on different legal and professional compliance teams (including ESG, EHS, antitrust, labor and employment, intellectual property, trade and data, finance and tax, business, criminal compliance and other professional teams related to ESG areas) to provide ESG due diligence services in supply chain management and M&A matters, and cooperates with enterprises and third-party agencies to draft ESG reports. Based on our experience in serving clients from different industrial backgrounds, we can provide a package of specialized services for the daily operations of enterprises, including specialized ESG-related legal and compliance diagnosis, as well as drafting and reviewing ESG-related terms and clauses in contracts with business partners, the construction and enhancement of ESG systems, the identification of ESG disclosure requirements, green finance, and ESG training.