Brief Comments on the Measures for the Security Review of Foreign Investments

2021.01.04 WEI, Yingling、YANG, Chen

In 2011, China debuted the National Security Review (“NSR”) regime for mergers and acquisitions of domestic enterprises by foreign investors in accordance with the Notice of the General Office of the State Council on the Establishment of Security Review System for Mergers and Acquisitions of Domestic Enterprises by Foreign Investors (the “2011 M&A NSR Notice”). In 2015, the NSR regime was further elaborated on with the issuance of the Notice of the General Office of the State Council on Promulgating the Trial Measures on National Security Review for Foreign Investment in Free Trade Zones (“2015 Free Trade Zone NSR Measures”), under which Free Trade Zones initiated the pilot implementation of the NSR program for foreign investment that accommodates the negative list administrative regime. Though the Foreign Investment Law (Consultation Paper) released in 2015 provides a detailed NSR regime, only principle provisions were kept in the 2018 draft and the final law, which came into effect on January 1, 2020.

On December 19, 2020, with the approval of the State Council, the National Development and Reform Commission (NDRC) and the Ministry of Commerce (MOFCOM) jointly issued the Measures for the Security Review of Foreign Investment (“2021 NSR Measures”), which will come into effect on January 18, 2021. The 2021 NSR Measures stipulate, in a total of 23 Articles, the types of foreign investments subject to the NSR, the reviewing authority, the industrial sectors covered by the NSR, the reviewing procedures, the supervision of the implementation of the reviewed decisions and punishments for violations of the reviewed decisions. We have summarized below the major provisions of the 2021 NSR Measures and the key differences between the 2021 NSR Measures and the 2011 M&A NSR Notice, as well as the 2015 Free Trade Zone NSR Measures.

I. Types of Foreign Investments Subject to NSR

The 2011 M&A NSR Notice differs from the 2015 Free Trade Zone NSR Measures in terms of the type of transactions subject to NSR. All kinds of foreign investments (including Greenfield investments) in the Free Trade Zone are subject to NSR, while outside the Free Trade Zone, only mergers or acquisitions of domestic enterprises by foreign investors are subject to NSR.

The 2021 NSR Measures refer to the 2015 Free Trade Zones NSR Measures and clarifies the types of foreign investments in China which shall be subject to NSR, including: (i) any foreign investor who solely, or jointly with other investors, invests in a new project or establishes an enterprise in China; (ii) any foreign investor who acquires the equities or assets of a domestic enterprise through merger or acquisition; or (iii) any foreign investor who invests in China in any other way. Namely, all types of foreign investments may be subject to NSR, including a newly established wholly-owned foreign enterprise, a newly established Sino-foreign joint venture, a merger and acquisition of a domestic enterprise by foreign investors, variable interest entity (VIE) structures, shareholding entrustments, etc.

II. Reviewing Authority

The 2011 M&A NSR Notice established the Inter-ministerial Joint Committee (IJC) responsible for NSR on mergers and acquisitions of domestic enterprises by foreign investors, while the 2021 NSR Measures replaces the IJC with a working mechanism for NSR on foreign investment, setting up a working office under NDRC (the “NSR Office”), for which NDRC and MOFCOM shall jointly organize and undertake the routine work of NSR on foreign investment. (Note: In accordance with NDRC’s Public Notice [2019] No. 4 , the government affairs services hall of NDRC, instead of MOFCOM, has been responsible for accepting the foreign investments declaration for NSR since April 30, 2019.)

According to the 2011 M&A NSR Notice, the IJC, under the leadership of the State Council and led by NDRC and MOFCOM, was to conduct NSR on mergers and acquisitions, jointly with the relevant state departments, in light of industrial sectors involved in merger and acquisition transactions by foreign investors. The 2021 NSR Measures set up the NSR Office to replace the IJC for NSR on foreign investment. However, given the NSR Office is led by, rather than just composed of NDRC and MOFCOM, and according to the normal working practices of the Chinese government, when conducting NSR on foreign investment, it’s likely that the NSR Office would seek opinions from competent government departments of the relevant industries, and even submit it to the State Council for a final decision. The detailed internal review process remains to be clarified in the follow-up practice.

III. The Industrial Sectors Covered by NSR

Pursuant to the 2021 NSR Measures, foreign investment in the following industrial sectors shall be subject to NSR:

1、Any military industry, military industrial accessories and other national defense and security-related sectors, and investment surrounding military facilities;

2、Important products and services in these industrial sectors: agriculture, energy and resources, equipment manufacturing, infrastructure, transport, cultural products and services, information technology and Internet, finance, key technologies, as well as any other sectors that have a bearing on national security and where foreign investors have obtained de facto control over these invested enterprises.

We prepared the following table to compare the differences between the industrial sectors covered by NSR according to the 2021 NSR Measures, the 2011 M&A NSR Notice and the 2015 Free Trade Zone NSR Measures.

Table 1: Comparison of the Industrial Sectors Covered by NSR among the 2021 NSR Measures, the 2011 M&A NSR Notice and the 2015 Free Trade Zone NSR Measures

2021 NSR Measures

2015 Free Trade Zones NSR Measures

2011 M&A NSR Notice

Investment in military industry, military industrial accessories and other national defense and security-related sectors, and investment surrounding military facilities;

Investments in important agricultural products, important energy and resources, important equipment manufacturing, important infrastructure, important transport services, important cultural products and services, important information technology and Internet products and services, important financial services, key technologies and other important sectors that have a bearing on national security, while obtaining de facto control over these invested enterprises.

Investment in the Free Trade Zones in military industry, military industrial accessories and other national defense and security-related sectors, and investment surrounding important and sensitive military facilities;

Investment by foreign investors in the Free Trade Zones in important agricultural products, important energy and resources, important infrastructure, important transportation services, important cultural and information technology products and services, key technologies, important equipment manufacturing and other important sectors that have a bearing on national security, while obtaining de facto control over these invested enterprises.

Merging with or the acquisition of the domestic enterprises of the military industry, military industrial accessories, enterprises adjacent to important and sensitive military facilities and enterprises in other national security and defense-related sectors by foreign investors;

Merging with and the acquisition of domestic enterprises in relation to important agricultural products, important energy and resources, important infrastructure, important transportation services, key technologies, significant equipment manufacturing and other important sectors that have a bearing on national security by foreign investors, and the de facto control of these invested enterprises may be obtained by foreign investors.

As illustrated in the table above, the industrial sectors subject to NSR as stipulated in the 2021 NSR Measures are broader than those provided in the two previous regulations. The change, in our view, marks an important step toward improving China’s foreign investment management system. This follows the Foreign Investment Law in 2020, which established a new foreign investment management system consisting of three major aspects: the negative list administration system for market access, the foreign investment information reporting system and the NSR system. The issuance of the 2021 NSR Measures is one of China’s major new regulations further promoting foreign investment, expanding further opening up while managing foreign investment rationally and scientifically, and ensuring national security.

In recent years, China has steadily expanded opening up and relaxed restrictions on market access for foreign investment. For example, in cultural sectors, China has abolished regulations prohibiting foreign investment in businesses that provide internet access services and the restrictions that cinemas and performance agencies must only be controlled by Chinese operators, and it has permitted foreign-invested enterprises to produce and sell gaming devices; in the financial sector, China has abrogated the restrictions on shareholding proportions of foreign investors in the banking, securities, funds, futures and life insurance sectors. While China continues relaxing market access restrictions, the United States, the European Union and other countries are constantly updating their NSR regime (also referred to as a “foreign investment review system”). It appears, given the timing of promulgation, that the 2021 NSR Measures are a reciprocal measure of the security review imposed by foreign authorities on Chinese enterprises, but in fact, this regulation is part of a formulation of policies managed by the Chinese government cautiously and steadily, which started with the 2011 M&A NSR Notice and continued through the 2015 Free Trade Zone NSR Measures, the 2015 Foreign Investment Law (Consultation Paper) to the 2020 Foreign Investment Law. For example, Article 59 of the State Security Law promulgated in 2015 stipulates that, “The State shall establish a review and regulatory system and mechanism for national security, and carry out national security reviews against foreign investments, specific items and key technologies, network information technology products and services, national security-related projects and other major matters and events that impact or may impact national security, in order to effectively prevent and resolve national security risks”, where the NSR on network information technology products and services (foreign investment involving such products and services should also be included) has already been referenced. In the financial service sector, Article 26 of the Administrative Measures on Bank Card Clearing Institutions promulgated in 2016 provides that “merger and acquisition of bank card clearing institutions by foreign investors shall comply with the administrative provisions on security reviews for merger and acquisition of domestic infrastructure by foreign investors.”

With respect to the determination of “obtaining de facto control over an invested enterprise”, while there are no substantial distinctions among the three documents referenced above, “de facto control” occurs in the following circumstances: (i) a foreign investor holds more than 50% of the equity of a domestic enterprise; (ii) a foreign investor holds less than 50% of the equity of a domestic enterprise while the voting rights vested upon such equity are sufficient for the foreign investor to exert a significant impact on the resolutions of the board of directors, the shareholders’ meeting or the general meeting of shareholders of such domestic enterprise; or (iii) other circumstances where a foreign investor exerts significant impact on the management decision-making, human resources, finances, or technologies of the domestic enterprise.

IV. Reviewing Procedures and Timelines

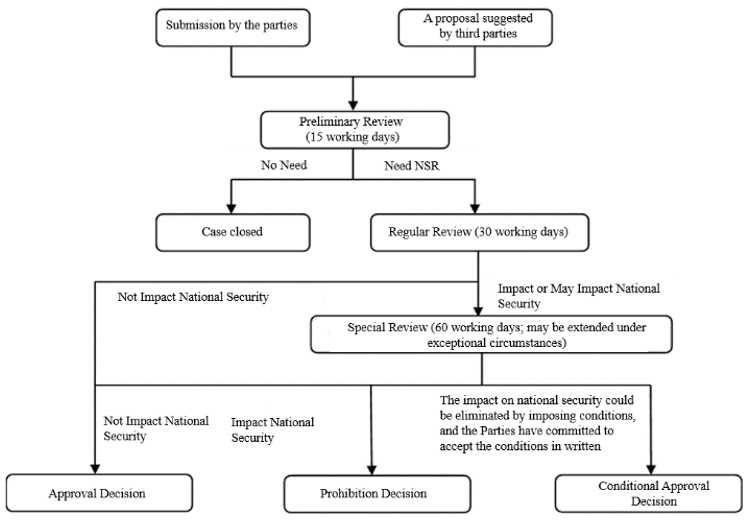

The 2021 NSR Measures and the 2011 M&A NSR Notice are not substantially different with respect to the initiation of NSR, which can be initiated in two ways: (i) a submission of a filing by the foreign investor or relevant entity within China (the “Parties”), and (ii) a proposal for a security review submitted by a third party . According to the 2021 NSR Measures, for a foreign investment falling within the industrial sectors covered by NSR, the Parties shall take the initiative to make the filing to the NSR Office prior to the implementation of investment. In the event the Parties fail to file the foreign investment with the NSR Office while the relevant authorities, enterprises, social groups or the general public or others believe that such foreign investment impacts or may impact national security, they may submit a proposal to the NSR Office for initiating the NSR.

In the most significant revision from the 2011 M&A NSR Notice, the 2021 NSR Measures simplify and clarify the NSR reviewing procedures and timelines. Firstly, by simplifying the NSR reviewing phases and removing the circumstances under which foreign investment is required to be reported to the State Council. The 2021 NSR Measures establishes a three-tiered reviewing system: preliminary review, regular review and special review. The aforesaid reviewing system is basically consistent with the 2011 M&A NSR Notice, except for the removal of the circumstances under which foreign investment is required to be reported to the State Council, e.g., “After initiating the special review procedure, in the event IJC has significant divergence on the security assessment of the merger and acquisition transaction, IJC shall submit the case to the State Council for a decision.”

Secondly, the timeline is clarified and simplified for each phase of the reviewing procedure. To be specific, (i) in Phase I of the preliminary review, the NSR Office shall decide whether or not to initiate the NSR within 15 working days from the date of receipt of the materials complying with filing requirements; (ii) in Phase II of the regular review, the NSR Office shall make the decision of passing the NSR or moving on to the next NSR phase within 30 working days of the NSR initiation date; and (iii) in Phase III, a special review lasts for 60 working days and may be extended only under exceptional circumstances. This final phase is unnecessary if a foreign investment succeeds in passing the regular review in phase two.

The 2021 NSR Measures expressly provide the timeline for each review phase and abolishes the provisions in the 2011 M&A NSR Notice regarding internal working processes and the time limits for security reviews. For example, “For merger and acquisition transactions falling within the NSR scope, MOFCOM shall submit the NSR filing within five working days to IJC for review”, “Upon receipt of an NSR filing submitted by MOFCOM for security review, IJC shall solicit opinions from relevant departments in writing within five working days. Upon receipt of the written letter for solicitation of opinions, the relevant departments shall provide written opinions within 20 working days”, “In the event that any department deems that the merger and acquisition transactions may have an impact on national security, IJC shall initiate the special review within five working days upon receipt of the written opinions.”

It is worth noting that pursuant to the 2021 NSR Measures, the NSR Office may request additional information from the Parties and ask the Parties about the relevant matters during the course of its review, which will stop the clock on the timelines described above. That is to say, the time for the Parties to provide supplemental relevant materials shall not be counted as part of the review time period. Besides, before a preliminary review, there is no explicit time limit required by law for the NSR Office to examine whether the materials meet the filing requirements.

The Reviewing Procedure of Foreign Investments

V. Review Decisions and Implementation Supervision

The NSR Office shall appraise and issue decisions accordingly to: (i) approve a declared foreign investment, where it does not impact national security; (2) prohibit a declared foreign investment, where it impacts national security; (3) conditionally approve a declared foreign investment, where its impact on national security can be eliminated by imposing certain conditions and the Parties give written undertakings accepting such conditions.

If a declared foreign investment passes the NSR, the Parties may implement the investment; if a conditional approval decision is made, the Parties shall implement the investment in accordance with the additional conditions; in case a declared foreign investment is decided as prohibited, the Parties shall not implement the investment, however, if the investment has been implemented, the Parties shall dispose the equity or assets and/or adopt other necessary measures within a specified time period to restore the pre-investment conditions and eliminate the impact on national security. The above provisions are similar to the relevant rules in 2015 Foreign Investment Law (Consultation Paper).

Additionally, the 2021 NSR Measures also provide the supervision on the implementation of the NSR decision. The implementation of the NSR decision will be supervised by the NSR Office together with the relevant government departments and local governments. For foreign investment that passed the NSR with additional conditions, the implementation of the additional conditions may be verified by requiring the submission of the relevant documentation, an onsite inspection or by some other means.

VI. Consequences of a Violation of the 2021 NSR Measures

Unlike the 2011 M&A NSR Notice which makes no mention of legal liability clauses, the 2021 NSR Measures explicitly provides for legal liability clauses. Pursuant to the 2021 NSR Measures, for violations such as refusing to file, providing fraudulent materials and failing to implement additional conditions, the NSR Office may order the Parties to dispose of equity or assets within a specified time period, as well as record the dishonest credit information of the Parties on the relevant national credit information systems and joint punishment shall be imposed on the Parties in accordance with the relevant provisions of the State. We understand that the relevant national credit information systems may include the national credit information sharing platform “Credit China” website and the National Enterprise Credit Information Publicity System. The joint punishment may include administrative, market, industrial and social restraints and punishments for conducting dishonest activities.

VII. Summary

Based on the NSR legislation and the implementation practices over the past ten years, particularly in the Free Trade Zones, the 2021 NSR Measures makes adjustments and supplements to the NSR review authorities, the industrial sectors subject to NSR, review procedures, supervision on implementation of review decisions, as well as punishments for violations, which further enhances the operability and transparency of China's NSR regime.